With interest rates rising over the last few months and at their highest level since 2008, there may be questions regarding how this may affect the investment performance of bonds.

What is a Bond?

A bond is essentially a loan to a company or government. In return they pay you a fixed rate of interest (the coupon), and the capital is repaid at the redemption date.

Bonds can also be traded on a secondary market in which the capital value varies depending on time to redemption, interest rates and inflation.

Why do we Invest in Bonds?

Bonds are less risky than stocks because creditors are paid before owners. As a result, they do not have the same levels of expected return.

Bonds are not highly correlated with equities (i.e., they produce returns at different times). This means that including bonds in a portfolio is a way to dampen volatility such that the investor has a smoother journey.

Bonds in an Increasing Interest Rate Environment:

As interest rates increase, the capital value of bonds decreases because new bonds offer a higher coupon.

For example: Consider the scenario where you hold a 10-year bond that had a 2% coupon and was purchased for £100. Interest rates then increased and you could purchase a new 10-year bond with a 3% coupon for £100.

The capital value (price) of the initial bond has to adjust because no one would pay the same for a bond yielding 2% per annum as a bond yielding 3% per annum. The price of the original bond falls in order that the fixed coupon now matches that available elsewhere (everything else being equal).

The longer the bond has left until maturity, the more susceptible the capital value is to changes in interest rates throughout its remaining term.

What might interest rate rises mean for the bonds we hold in our portfolios?

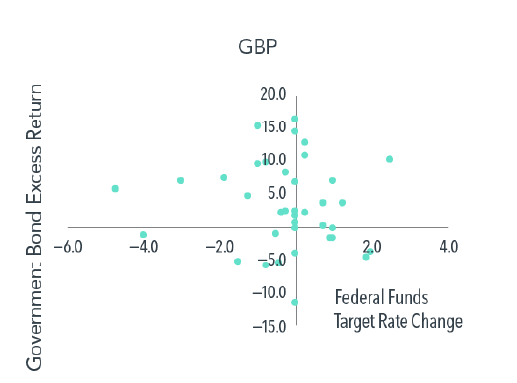

The honest answer is it is very difficult to say. Research undertaken by Dimensional shows that there is no correlation between changes in the Federal interest rate and the excess return of bonds over cash in the following year.

This is shown in the chart below.1 This is because the return from bonds is composed of both the capital value and the coupons received until maturity. This second part of the return equation is often overlooked.

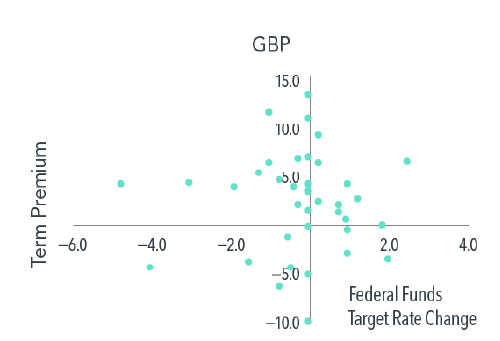

Furthermore, Dimensional found that there was no correlation observed between the change in Federal rate and future term premiums (i.e., higher expected return from longer duration bonds).

The bonds held in bdb portfolios are of a high quality, they are internationally diversified and overall sit on the lower end of the term spectrum.

In conclusion, bonds remain an important part of any sensibly constructed portfolio regardless of what might be happening with respect to interest rates at any given time.

1https://www.dimensional.com/us-en/insights/all-eyes-on-the-fed-a-look-at-federal-funds-rate-bond-return-and-term-premium

Posted by: Samantha Hawken | Posted in: News