But you already knew that right? It is written on pretty much every piece of financial advertising literature you will have come across.

Whilst you may not have paid much attention, you will almost certainly have seen the adverts for investment funds in the Money section of the newspaper, on the side of a taxi, ski lift, on the jersey of your favourite cricket team or whilst waiting for the underground in London.

You know the ones, they are usually accompanied by an image of a lion, a compass or a yacht navigating towards the horizon.

Quite often the advert will prominently feature a list of awards won by the manager, team or company for excellence in their specific area of focus in the investment universe. The one thing you will almost certainly see, is a boast of the performance of the fund over the last one, three or five years and where they finished in the investment league tables.

Then, right at the bottom often hidden away in small cap you will find the health warning. It goes along the lines of ‘past performance is no guide’. Most will skim over it or barely notice it at all, putting it down to legalise, jargon or compliance blurb to be ignored.

The problem is that it is true and the evidence for this statement is overwhelming.

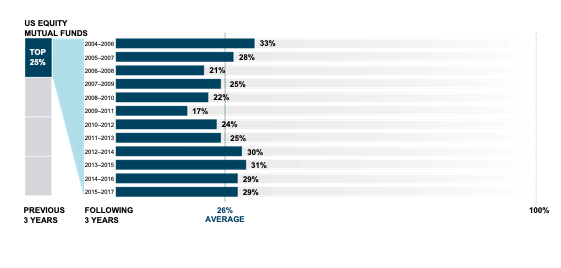

Percentage of US mutual funds that were top quartile performers in consecutive three year periods.

Source: Dimensional fund advisors

The above chart shows that only 26% of top quartile ranked US equity funds over a three year window then went on to be top quartile. This story persists across geographical areas, sectors, investment periods and asset classes.

When you truly understand this, the connotations are immense. What this little health warning really means is that all of that stuff around being top of the table or boasting about what investors have received in the past is essentially useless information when deciding with whom you should entrust your money and your family’s future. The warning fundamentally contradicts the message.

Past performance is no good to you if you weren’t invested. It is future performance you really want. All of this raises the fundamental question, if this is true, then why do people still pick funds based on their historical performance?

I suspect the answer is complex but I am willing to speculate a little here:

For lots of investors and advisors this is all they have to go on and with the lack of a more in depth understanding they simply plough on with the absence of an alternative. For them, a little knowledge can be a dangerous thing.

Investors and advisors have been convinced for years that using past performance is the way to a successful investment outcome but have never taken the time to look back with a scientific view on how successful they have been with this strategy. Where there has been successes, why has it worked for them, skill at picking managers? or just plain luck? Human beings love to see a pattern or a relationship but correlation is not causation.

Then there is good old greed. The cynic in me suggests that we can’t help but be attracted to headline grabbing rates of return or stories of historical success. Marketing departments know it, and investors continue to demand the performance numbers, it’s a vicious cycle.

Whatever the reason, it is proven to be a broken strategy.

Why should you care? Well, this affects everyone. We all have money invested with a fund manager at the very least within our workplace pensions. Perhaps it's time to think about who that manager is, and how they are deciding where your money should be invested. Perhaps it's you picking the funds, why did you choose the ones you did?

Being an evidence based investor means exactly that. There is no evidence that suggests that the so called winners can repeat with any level of consistency.

There is however a better way. Perhaps investors just need to know an alternative exists, one bdb advocates and practices. By constructing an investment philosophy grounded in science, with core beliefs built on evidence and portfolios designed to harvest returns efficiently rather than relying upon a manager’s ‘skill’ or track record, you can maximise the chances of your success. No health warning required.

Posted by: Matthew Kiddle | Posted in: News