“Insanity is doing the same thing over and over and expecting different results.” Albert Einstein

Whilst fashions come and go, in the world of investing it seems that some things will always remain the same. One of those is investors' reactions to drawdowns in investment markets. Fear and greed are two hugely powerful human drivers of behaviour and I don’t see that changing any time soon. So it comes as no surprise to have observed the same destructive patterns repeating themselves over and over again in the twenty years I have spent in the world of investing.

What am I getting at here? Well, it's another announcement of record outflows from investment funds in 2022, this time for UK investors to the tune of £25.7bn. Naturally, this corresponds with a downward year for the major equity and bond asset classes. Presumably, much of this cash remains in deposit accounts whilst the market surges ahead in the opening weeks of 2023.

It is not difficult to understand why people continue to buy at the top and sell at the bottom given the power of their human instincts, but when repeated, this is a surefire way to bankruptcy.

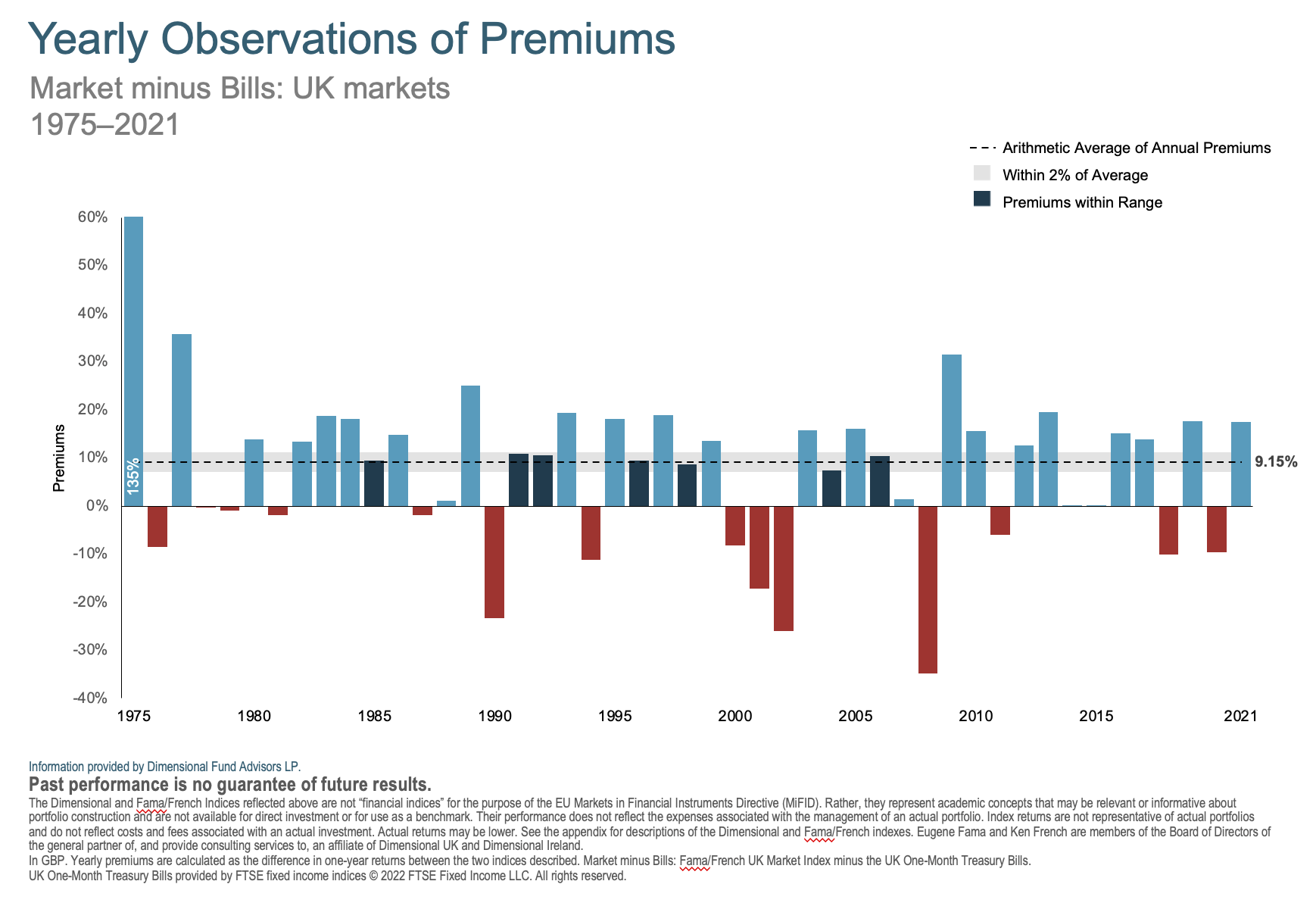

Whilst we’d all love our portfolios to steadily grow year on year with inflation-beating returns, this just isn’t how it works. ‘Risk’ is the price we have to pay so that we can have the opportunity to capture inflation-beating returns. A negative year reminds us that we have risk in our portfolios which is a good thing. A measurement of risk is a measure of how uncertain the outcome is for any given time period. The higher the risk, the greater the chance you do not achieve the returns you are targeting, but the higher the expected returns.

For properly diversified investors like our clients, whilst it was negative, 2022 was not a particularly standout year for performance. Things are working as they should. It is the accumulation of all of the ups and all of the downs over long time periods which add up to the average inflation-beating returns your financial plan needs.

The chart below shows that only a fraction of annual returns lie close to the average we seek from our portfolio.

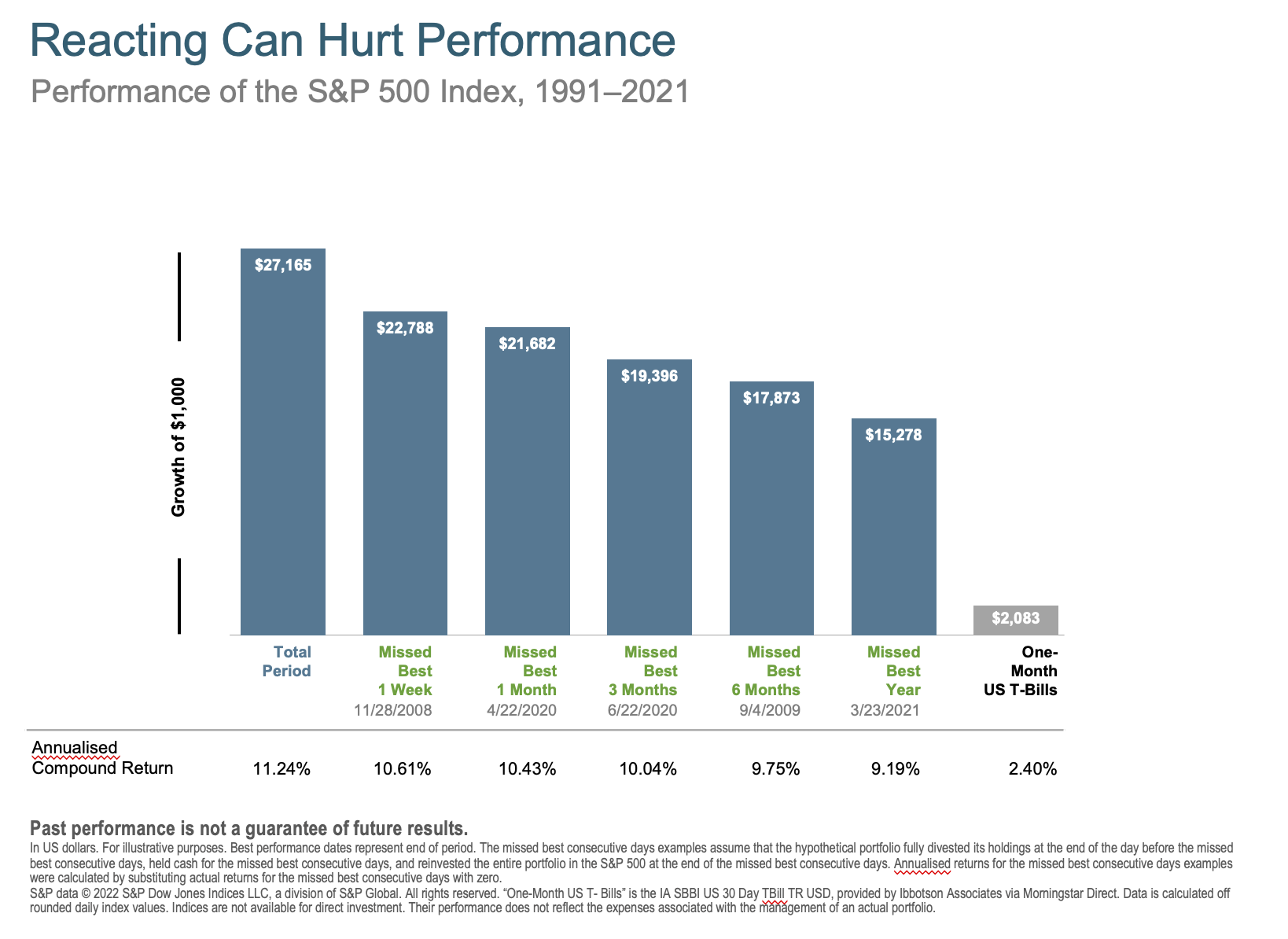

I make no apologies for sharing the below chart again as it's a firm favourite with us and our clients.

Trying to time the market is a fool's errand when you factor in the effect of missing only a handful of the best days over even a very long-term investment horizon. Great if you can see into the future to when the best days will be, but we haven’t yet met anyone who can, despite the claims of the active management investment community.

You can only conclude that investors are a far bigger threat to their portfolios than the markets!

Suffice to say, those who have understood the need for patience and discipline are already reaping the benefits in the opening weeks of 2023.

Posted by: Matthew Kiddle | Posted in: News