The past few years have been a period of relatively high volatility for investment markets. Volatility is the jargon us investment professionals use for the bumpiness of the ride and is measured by comparing how widely a data set is scattered around its average.

One thing is for certain with an evidence based approach (which is that of bdb) is that when markets go up, so do portfolios, and likewise the same is true when markets go down.

This is because our focus is on capturing the risk and return characteristics of the market rather than trying to beat it through stock selection, market timing or other activity. This second approach is called active management and is still favoured by the majority of investors today.

Clients of bdb will be familiar with why we adopt an evidence based rather than active approach and you can find many articles on our website sharing the evidence of its superiority and the rationale.

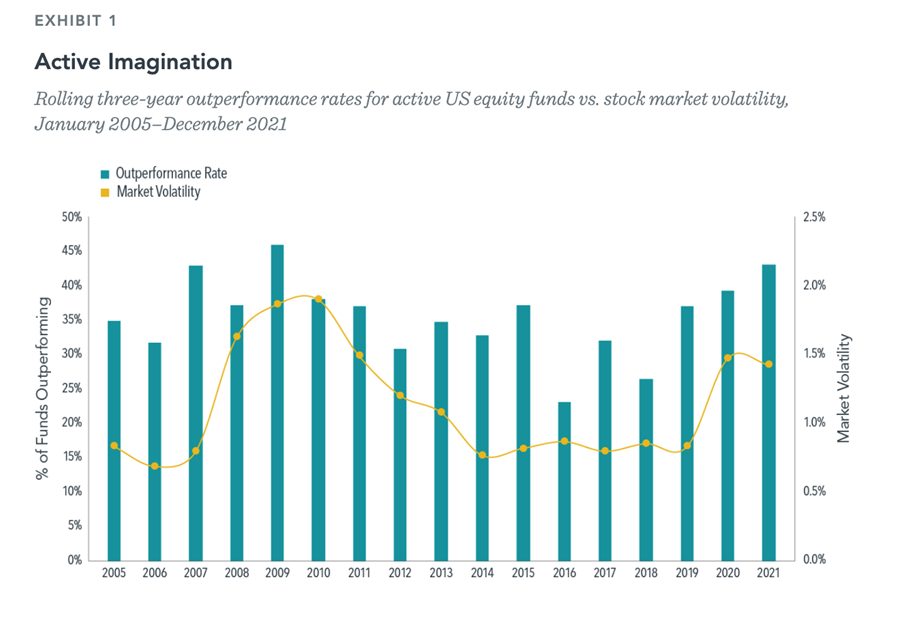

One common claim by active managers is that during times of volatility they can help steer a course to superior outcomes as they are free to position the portfolio to protect against predicted downturns and time the rallies in advance.

Recent research from Dimensional shows this to be another case of myth often accepted as fact. The chart above shows that the majority of managers underperform in periods of both high and low volatility.

'So what?' you might say, I will choose one of the talented outperforming managers by looking to their track record.

Sadly, this won’t work for you either, as our previous pieces have explained. The ‘winners’ do not repeat and you’ll need to live beyond 2100 before you know whether your manager was skilful or just got lucky!

It is the unpleasant truth that to capture the long-term returns from your portfolio you deserve for taking on the risk of investment, you have to ride all of the ups and all of the downs. If patient enough, the evidence shows you will be rewarded.

Many continue to prefer the comforting lie and their chances of investment success are much reduced.

Posted by: Matthew Kiddle | Posted in: News