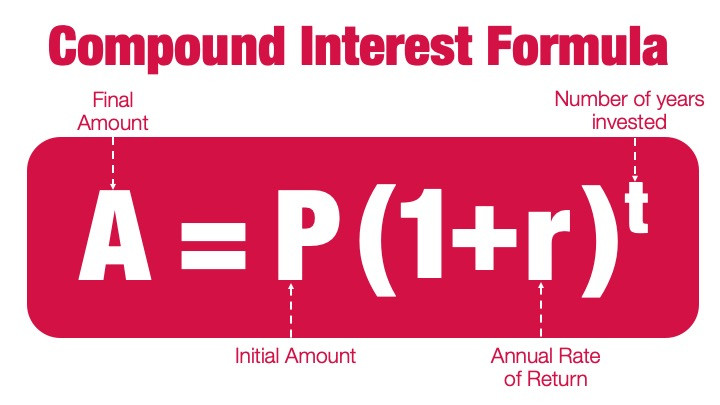

Forgive me, I want to talk mathematics for just a moment. It might just be the most important maths lesson you ever have. It's reasonably simple and I promise to keep it quick. This formula is probably the most important one in your financial life, no matter who you are or where you come from, rich or poor, leaver or remainer.

This formula describes how an invested pot will grow over time or a debt will accumulate. From your pensions to savings to your mortgage or student loan. Like Newton’s laws of Physics it is a fundamental truism. It cannot be cheated, bent or avoided no matter how it may be presented in the literature you read from your investment or loan provider.

By far and away the most important symbol here is t (time). t is small and high because it denotes “to the power of”. It means that the growth or interest rate is applied to the amount already accumulated. This is the compounding part and that which many people often forget or fail to grasp.

If t is for example 5 years that means that the interest rate must be multiplied by itself five times. So for an r of 5% and an initial investment of £10,000 we end up with 1.05x1.05x1.05x1.05x1.05 = 1.277 x £10,000 =£12,762. This is £262 more than simply adding up 5% on £10,000 (£500) five times. This is the effect of compounding at work.

The thing is that when time gets large, small changes in r (rate of growth or interest rate) have mighty impacts on the outcome. One of the core principles of bdb’s investment philosophy is to keep costs down and this formula is the reason. We know that by shaving off only a fraction of a percentage point on the cost of investing, over long investment horizons the change in outcome can be enormous, life changing even.

The opposite is also true and it is great to see the financial press giving light to the scourge of high costs in ordinary people’s investment portfolios which has gone on for too long.

When it comes to debt, what this formula shows you is the true cost of your borrowing over time. Debt providers know this and will quite often lead with the monthly repayment cost. However this formula says that a lower monthly repayment will mean a higher total cost to you and sometimes its worth thinking about that. Is there a saving to be made somewhere else that allows you to overpay that mortgage? A 10% overpayment will knock years off of the term, many thousands off the total repaid and who knows, an earlier and more prosperous retirement.

You will have come across this before in one form or another. The next time you think about how your long term investments are set up, consider how much it is costing per year and what does that mean for the likely end result. It is probably much larger than it might initially seem. When considering your loans, what is the true and total cost to you of the interest over the full term rather than the short term payment from month to month.

After all those from whom we purchase such products understand this law deeply and we owe it to ourselves to do so too.

Posted by: Matthew Kiddle | Posted in: News