There was a lot of noise in November 2019 surrounding the rush to open a Help to Buy ISA before the deadline (and for those who missed it). We will explain the reasons why there was no need to panic. There is a better alternative - the Lifetime ISA (LISA).

What is a LISA?

To put it simply, a LISA is a tax-efficient wrapper in which to hold your cash or investments. It also benefits from a 25% government bonus on each contribution. It is used as a savings vehicle designed for retirement or for a first house deposit. We don’t see it as an effective product for retirement so will focus on how it assists in purchasing a property.

There are a variety of rules that must be followed to receive the 25% bonus:

- You have to be between age 18 - 39 to open a LISA (it can be contributed in until age 50).

- It needs to be held for 12 months before the date in which you purchase a property. A maximum of £4,000 a year (2020/21) can be contributed to a LISA.

- It can be used to purchase properties that are valued up to £450,000.

- If the funds are withdrawn other than to buy a first house, retirement at age 60, terminal illness and within the 30-day cooling-off period there is a 25% withdrawal charge. This is on the entire account (including bonuses) which means you will get out less than you put in.

Types of LISAs

There are two types of LISAs: cash or stocks & shares accounts. The choice between the two will be driven by your risk capacity which is largely related to the timescale until the funds will be required.

If the answer is in 5 years or less, then it is most likely to be a cash LISA. There is too high a chance that you will get back less than you put in. Cash LISAs receive interest from the bank which will be at a rate typical of a normal savings account.

Stocks & shares LISAs invest in securities or funds. They have a higher growth potential but also have a higher probability that you will get less than you put in. This is why an increased risk capacity or time horizon is required.

LISA vs Help to Buy ISA

Investment amounts and bonuses

You can put more money into a LISA than an existing Help to Buy ISA with both receiving a 25% bonus.

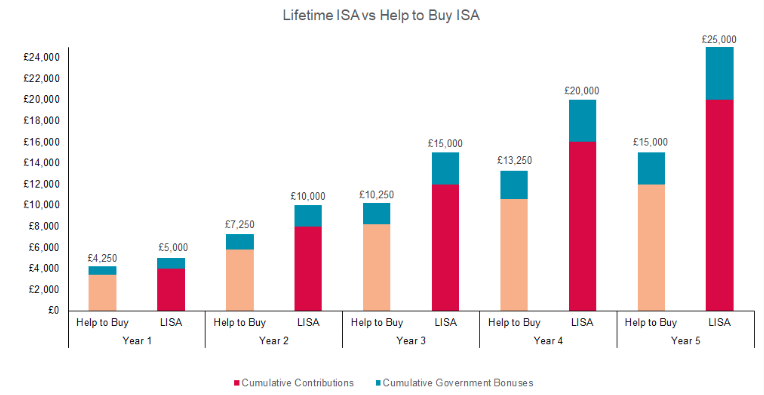

The Help to Buy ISA has a maximum contribution of £200 per month (£2,400 per annum following a maximum initial contribution of £1,000). The ceiling on total contributions is £12,000 (with a capped bonus of £3,000) which will take around 5 years to reach. The chart below shows the maximum funding of the LISA vs Help to Buy ISA and cumulative government bonuses. (full annual allowances assumed to be utilised and interest has been ignored).

The bonus for the LISA is not capped (but is limited by age) and can be paid until age 50. If the annual allowance is utilised every year from age 18, the total government bonus would be £32,000 (£33,000 depending on when your birthday falls).

Frequency of bonuses and investment

LISA bonuses are awarded upfront (within 4-8 weeks of the contribution) which means they can be invested or experience growth from compounded interest. This return on bonuses is not available with Help to Buy ISAs as the bonus is only paid upon redemption.

Uses of LISAs vs Help to Buy ISA

LISAs can be used for a house deposit up to a price of £450,000 whereas Help to Buy ISAs can only be used for a deposit up to £250,000 (£450,000 in London). The LISA allows you to put more away and receive a larger total bonus and an improved prospect for higher long term returns.

There is no penalty to the Help to Buy ISA if the funds are withdrawn (the bonus is not paid). The LISA incurs a penalty for withdrawing the funds but we do not perceive this to be a problem if they are used for their purpose, such as saving for a house.

Posted by: Anick Sharma | Posted in: News